The credit union sector is rapidly evolving and becoming an increasingly bigger player in the financial services sector. Here’s what experts say are four trends to watch in the credit union industry in 2023:

DEEPER DIVE: New tax laws impacting your 2023 taxes

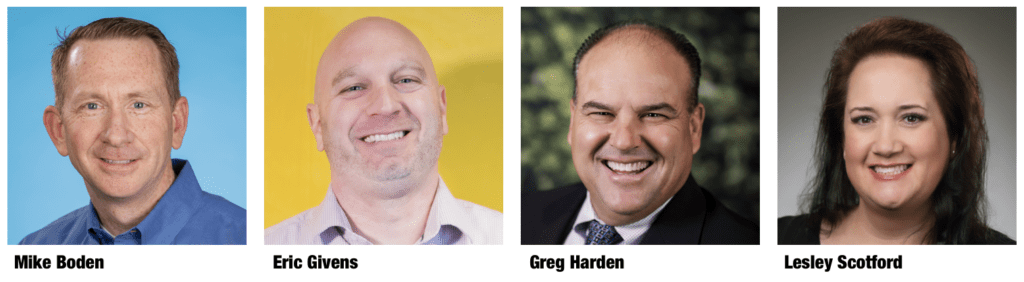

Mike Boden, executive vice president, chief financial officer and chief operating officer at OneAZ Credit Union: “An increased focus on the importance of technology at all levels. New technology, specifically AI and data-analytics tools, are changing everything a modern credit union does. From marketing and member acquisition to retail operations and engagement, no department or sector will be untouched by these advancing technologies. One thing that’s unique about credit unions is that we are truly member focused. So, we’re harnessing these new technologies in ways that enhance members’ lives, improve their financial well-being, and ultimately help them achieve their goals on their terms.”

Eric Givens, vice president of research and development, Arizona Financial Credit Union: “Underwriting that uses artificial intelligence to help with credit decisions is going to be something that will become more common in the next few years. There’s so much data available now, so why not use powerful software to make the best possible decisions? Historically, this type of software was difficult for credit unions to utilize due to the limited resources they have compared to $100 billion banks. However, now there are several different fintech partners catering to credit unions who offer AI underwriting models, which helps level the playing field.”

Greg Harden, president and CEO, Arizona Central Credit Union: “Continuing to focus on creating new efficient service delivery channels that still provide human interaction. Consumers interact with friends/family through video chat; it’s a logical assumption they may want to interact with their financial services provider that way. Adds a level of security and helps develop relationships. Some member issues may need more than an e-mail or text, but not require a trip to a branch.”

Lesley Scotford, vice president of member services, TruWest Credit Union: “The payment landscape for sure, considering most people do not even carry cash anymore. There are so many more options available to move money between two places than ever before. From the traditional use of plastics and now the ability to integrate them into the Digital Wallet and be digitally issued, to Zelle, Venmo, AppleCash and beyond, being able to provide and support these solutions to our members is a focus for us in 2023.”